The Psychology of Buying a House

The Agent as a 'Surrogate Prefrontal Cortex': The Hidden Neuroscience of a Real Estate Deal

Why the best agents aren’t salespeople—they are external regulators for your brain. A scientific look at how real trust is built.

That familiar, uncomfortable feeling. The knot in your stomach when looking at property prices. The sleepless nights, wondering if you’re making a catastrophic mistake.

This isn’t just “stress.” It’s a predictable biological response. Buying or selling a home is one of the most high-stakes decisions of your life.

This article isn’t about market trends; it’s about the psychology of buying a house and the hidden neuroscience that governs your decisions.

It explains why the commitment happens not at the paperwork stage, but the moment your nervous system finally feels safe.

The Universal Problem: Your Brain on a High-Stakes Transaction

To understand why real estate decisions feel so overwhelming, you first have to understand the civil war happening inside your head. It’s a biological battle between two parts of your brain that are in direct conflict.

The Battle in Your Head: Amygdala vs. Prefrontal Cortex

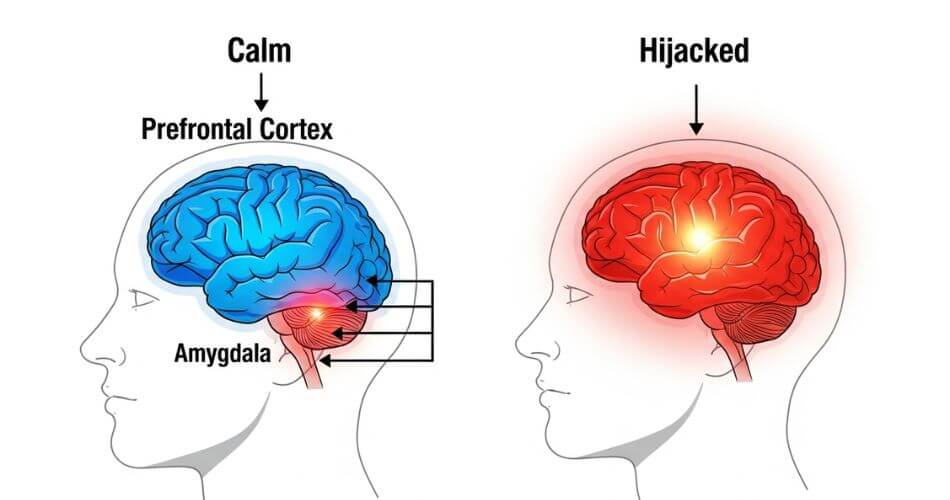

In a stable, calm environment, your brain operates in a state of functional balance. Your decision-making is led by your prefrontal cortex (PFC).

This is the “executive” center of your brain, located behind your forehead. It provides “top-down” control, allowing you to regulate your emotions, assess long-term consequences, and engage in goal-directed, logical behavior.

It’s the part of your brain that makes spreadsheets, sets budgets, and thinks about the future.

Working alongside it is the amygdala. This is your brain’s “surveillance system,” constantly scanning your environment for emotionally important stimuli, especially threats. It is designed to ask one simple question: “Am I safe?”

In a normal state, the PFC is the CEO, and the amygdala is the head of security. The CEO is in charge, listening to security’s concerns but ultimately making the final, rational decision.

The Science of 'Amygdala Hijack': Why Logic Fails Under Pressure

A high-stakes real estate transaction is not a stable environment. The significant financial and emotional weight acts as a “potent stressor.”

This stress initiates a well-documented cascade of neurochemical events in your brain, releasing a flood of catecholamines (like adrenaline) and glucocorticoids (like cortisol).

Your prefrontal cortex, your logical CEO, is uniquely sensitive to this chemical flood.

Research, including the work of Arnsten (2009), shows these stress neurochemicals have a devastating, double-edged effect: they disrupt the signaling pathways in your PFC, effectively impairing its “top-down” executive function.

At the exact same time, these chemicals enhance the processing and control of the more primitive amygdala.

This neurological shift is known as an “amygdala hijack.” Your brain’s control center literally shifts from the thoughtful, logical PFC to the rapid, reflexive amygdala.

The head of security takes over the entire building. This shift leads to a marked change in your behavior. You lose cognitive flexibility, and your thoughtful, goal-directed behavior is replaced by rigid, “stimulus-response” conduct.

You experience “tunnel vision,” focusing only on the threat. This is the core of the neuroscience of decision-making under stress.

The Functional Vacuum: The Biological Need for an External Guide

What is often dismissed as a client “being emotional” or “irrational” is, in fact, a predictable biological state.

When your amygdala is hijacked, you are biologically incapable of the exact, clear-headed, rational thought the situation demands.

Your logical brain is biochemically suppressed. You are operating from a reactive, fear-based posture.

This biological state of impairment creates a “functional vacuum.” Your brain needs an external source of executive control to help it regulate the fear and find its way back to logic.

This is where the true role of a real estate agent is defined, not as a salesperson, but as a biological regulator.

The agent’s primary job is to step into that vacuum and become, in effect, a “surrogate prefrontal cortex” for you, the client.

The Agent's Intervention: A Scientific Look at Building Safety and Trust

If a hijacked amygdala is the problem, a “surrogate PFC” is the solution. This process of one person helping to regulate another’s nervous system is not a metaphor; it is a well-established scientific process.

It happens through a dual-channel intervention: one non-verbal, the other verbal.

The Non-Verbal Channel: How Your Nervous System 'Hears' an Agent's Tone (Polyvagal Theory)

This intervention is part of a process called “interpersonal emotion regulation,” or “social buffering,” where the presence of a calm social partner can block a fear response.

The “how” is explained by Stephen Porges’s Polyvagal Theory.

Neuroception: The Unconscious Scan. The central construct of this theory is “neuroception.”

This is an unconscious process by which your nervous system, operating below the level of conscious thought, is constantly scanning the agent for cues of safety or danger. It is evaluating the agent’s state, not their words.

Cues of Safety. Your nervous system is looking for “cues of safety.” The most powerful of these are a calm vocal prosody (a measured, reassuring tone of voice) and warm, welcoming facial expressions.

These are not superficial pleasantries; they are critical biological signals.

The Social Engagement System. When your neuroception detects these safety cues, it activates your “Social Engagement System,” which is mediated by the Ventral Vagal Complex (VVC).

Activating this system physiologically calms your body. It down-regulates the defensive “fight-or-flight” state and fosters feelings of safety, trust, and social connection. This is polyvagal theory in business communication in action.

This non-verbal channel is the gatekeeper. Your nervous system hears the “music” (the agent’s tone) before it can process the “lyrics” (the agent’s words).

If the agent’s “music” is anxious, rushed, or dismissive, your neuroception will detect a threat, your defensive state will remain, and the agent’s logical advice will be rejected.

The Verbal Intervention: The Power of 'Affect Labeling' to Calm the Fear Center

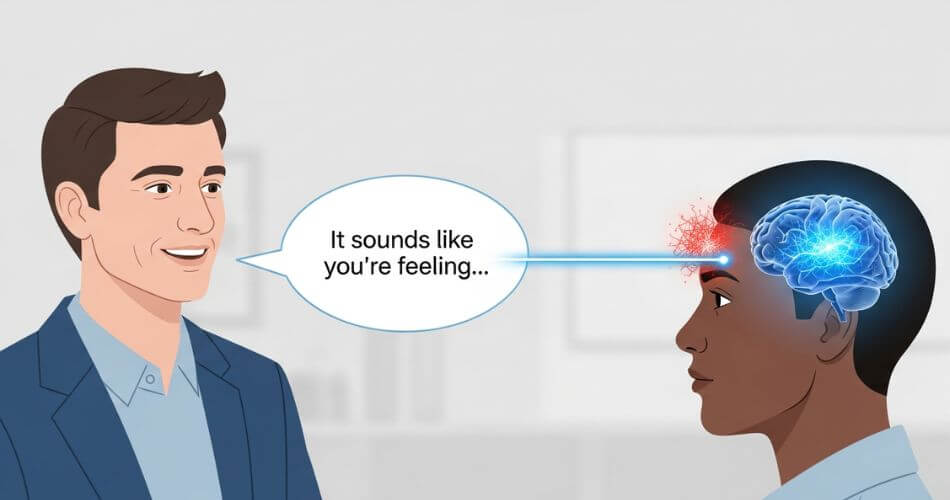

Once the non-verbal channel of safety is secured, the agent can deploy the verbal intervention. The most potent tool for this is “affect labeling,” a concept with a direct, verifiable neuroscientific basis.

Research by Matthew Lieberman and colleagues, using fMRI, demonstrated what happens in the brain when an individual “puts feelings into words.”

When an agent “labels” your emotion (e.g., “It sounds like you’re feeling overwhelmed by this process”), it is an active cognitive intervention.

The fMRI data shows that this simple act causes two critical events in your brain simultaneously:

- Amygdala Deactivation: Activity in your amygdala decreases. The alarm bell gets quieter.

- PFC Activation: Activity in your right ventrolateral prefrontal cortex (RVLPFC), a key region for executive control, increases. Your logical brain comes back online.

This is the “surrogate prefrontal cortex” in its most literal form. The agent’s external act of naming your fear re-activates your own prefrontal cortex.

This allows your brain to “hit the brakes” on its own amygdala-driven fear response, dampening the emotion and restoring your ability to think logically.

This is the scientific answer to what is an amygdala hijack in sales and, more importantly, how to reverse it.

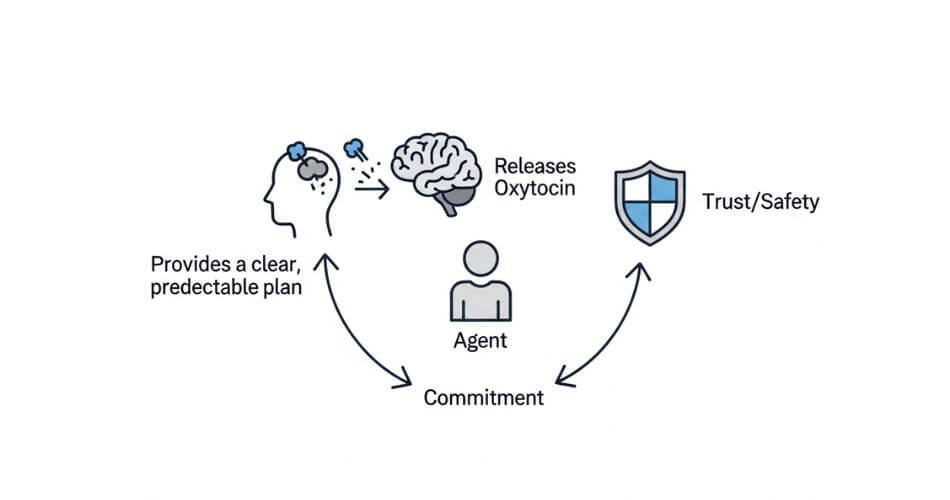

The Biochemistry of Commitment: Creating an Oxytocin Loop of Trust

The successful execution of this dual-channel intervention moves you from a state of threat to a state of safety.

When this is reinforced, that state of safety transitions into a durable, long-term bond of trust. This transition is not merely psychological; it is biochemical.

The hormone oxytocin is the primary neurochemical mediator of this process. Often called the “trust hormone,” oxytocin is pivotal in fostering feelings of trust, empathy, and social bonding.

This is the foundation of the role of trust in high-stakes transactions.

This oxytocin-driven trust is not built by a single grand gesture. It is cultivated through a “positive feedback loop” created by specific, repeatable behaviors.

Research into mammalian bonding shows that oxytocin release is critically linked to “a specific set of highly repetitive and predictable behaviors.”

This finding has immense implications. You enter the real estate process in a state of high-stress amygdala hijack precisely because the environment is chaotic and unpredictable.

Therefore, the agent’s most powerful tool for building trust is the antidote to uncertainty: a clear, consistent, and predictable process.

An agent who provides a structured, predictable plan (e.g., “Every Tuesday, we will review the market update,” “After every inspection, we will follow this exact 3-step process”) is not just being a good project manager.

At a neurochemical level, they are creating the exact conditions for oxytocin release.

This “boring” predictability functions as an essential “social buffer” against the chaos, systematically converting the fleeting feeling of “safety” into the deep-seated, chemical bond of “trust” and, ultimately, commitment.

The 'Psychological Theatre' in Action: Specific Anxieties and Solutions

This universal mechanism applies differently to different people. The “psychological theatre” of a senior seller is not the same as that of a first-time buyer.

A true “surrogate PFC” agent understands how to adapt the intervention to the specific anxieties of the person in front of them.

Profile 1: The Senior Seller (The Fear of Loss and Grief)

For the senior seller (55+), the transaction is rarely just financial; it is a deeply emotional, and often non-voluntary, life transition. The agent’s role is that of a “Compassionate Project Manager.”

Core Anxieties: Their amygdala is triggered by specific fears.

- Profound Emotional Attachment: They are not just selling an asset; they are leaving an archive of their life’s memories, often after 30+ years. This triggers genuine grief.

- “Relocation Stress Syndrome” (RSS): This is a recognized psychological and medical condition. The physical and emotional “overwhelm” of decluttering, packing, and moving can feel “insurmountable.”

- Financial Insecurity: The sale is often directly tied to their financial security in retirement. The fear of “not selling for enough” or misjudging future costs is intense.

- Mistrust of Digital Processes: A significant and often underestimated anxiety is the “age-related digital divide.” Fast-paced digital technologies like e-signatures and online portals feel impersonal, challenging, and a source of deep mistrust.

The “Surrogate PFC” Intervention: The agent’s function is to buffer these specific anxieties.

The antidote to the overwhelm of RSS is to slow down. A fast-talking, high-energy agent will be neurocepted (via Porges’s theory) as a direct threat.

The “surrogate PFC” agent consciously slows their vocal prosody, sits with the client, and breaks the “insurmountable” process into small, manageable steps. This slowness is a direct “cue of safety” to the client’s nervous system.

Against digital mistrust, the agent becomes the human interface. They sit with the client and “drive” the technology for them, providing a “social buffer” against the anxiety of the digital process.

Finally, to address the grief, the agent uses “Affect Labeling” not to “fix” the sadness, but to validate it: “It sounds like you’re feeling a real sense of loss about leaving this home.

That makes perfect sense.” This act of naming the emotion brings the client’s PFC back online and builds the oxytocin-based trust that a “salesy” agent can never achieve.

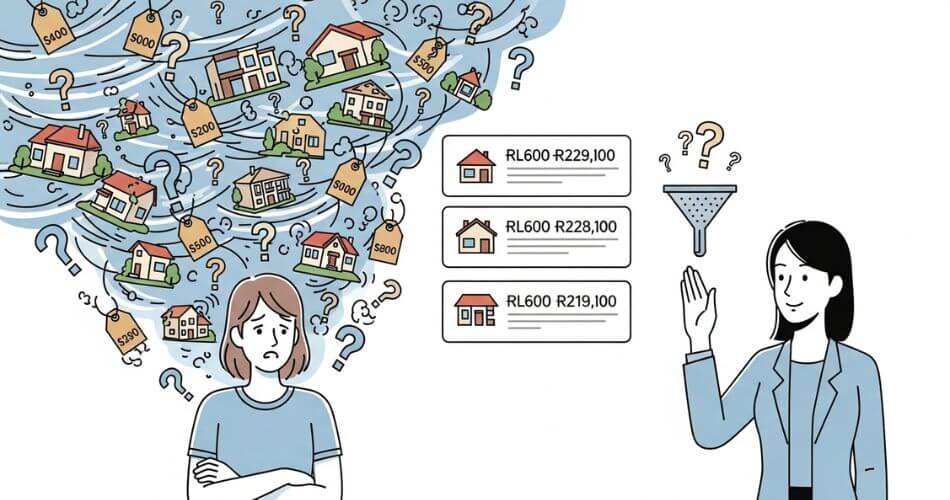

Profile 2: The First-Time Buyer (The Fear of a Catastrophic Mistake)

The First-Time Buyer (FTHB) faces a different, but no less intense, “psychological theatre.” Their anxieties are not of loss, but of error. The agent’s role here is that of an “Expert Filter and Normalizer.”

Core Anxieties: Their amygdala is triggered by a different set of fears.

- Fear of Catastrophic Financial Mistake: This is the paramount fear. They are terrified of making a massive financial blunder, overspending, or encountering unforeseen issues.

- “Imposter Syndrome”: A pervasive, often-unspoken anxiety. Many FTHBs feel like “frauds” who do not “deserve” to be homeowners, that they are ill-prepared and will be “found out.”

- “Decision Fatigue” & Information Overwhelm: The modern home search, with its endless online portals, provides too much information. This “choice overload” leads directly to “decision fatigue,” a documented psychological state that degrades the quality of decision-making.

The “Surrogate PFC” Intervention: The agent’s primary function is to reduce the client’s cognitive load and normalize their intense emotional experience.

The antidote to “decision fatigue” is to be an “Expert Filter.” A bad agent “data-dumps” 50 new listings. The “surrogate PFC” agent curates the market.

They do the pre-work, sifting through those 50 listings to present only the three that are a true match. This act of curation is a direct functional intervention, preserving the client’s limited PFC resources.

The antidote to “imposter syndrome” is to be “The Normalizer.”

The agent uses “Affect Labeling” to create a safe space for “stupid questions.” When the client expresses doubt, the agent labels and normalizes it: “It sounds like you’re feeling a bit of imposter syndrome.

That is the most normal feeling in the world for a first-time buyer.” This verbal act defuses the amygdala’s fear response and builds oxytocin-based trust.

Finally, the agent acts as the “Objective Anchor,” providing the objective data (comps, budgets, inspection analysis) that the client’s hijacked brain needs to fight its financial fear.

Profile 3: The Ambitious Agent (A Trainable, Operational Toolkit)

For the professional agent reading this, the “surrogate prefrontal cortex” model is not just a theory; it is a trainable, operational toolkit.

It provides a clear, evidence-based framework for “flipping the script” from sales to science. It explains why these techniques work, moving them from “sales hacks” to applied neuroscience.

The following model synthesizes all these concepts into a practical sequence.

The 'Be-Listen-Do' Model: The Three Pillars of a Master Advisor

This framework integrates therapeutic presence, negotiation tactics, and conflict resolution principles into a practical sequence for intervening in a client’s “amygdala hijack.”

Pillar 1 (BE): Mastering the 'Non-Anxious Presence'

The first pillar is BE. Before you can regulate someone else, you must regulate yourself. This concept comes from Edwin Friedman’s Family Systems Theory, which identifies the power of a “Non-Anxious Presence.“

Anxiety is contagious. A “non-anxious presence” is a person who is “able to stay calm in the storm of anxiety” around them. This is the practical application of Porges’s Polyvagal Theory.

An agent who has mastered their own internal state can project the “cues of safety” (calm prosody, relaxed facial muscles) that a client’s nervous system needs to see.

An internally anxious agent will be neurocepted as a threat, triggering the client’s defenses.

This presence is distinct from two common traps: “enmeshment” (an “anxious presence” that absorbs the client’s anxiety) and “detachment” (an “anxious absence” that dismisses it).

Self-regulation is the non-negotiable prerequisite for co-regulation.

Pillar 2 (LISTEN): Using 'Tactical Empathy' to De-escalate Fear

The second pillar is LISTEN. This is the active toolkit for diagnosing and de-escalating the client’s amygdala hijack in real-time.

This framework, termed “Tactical Empathy” by former FBI negotiator Chris Voss, is the verbal execution of the science. It consists of two primary skills:

- Mirroring: This is the simple repetition of the client’s last 1-3 words (e.g., Client: “The market is just moving too fast!” Agent: “…moving too fast?”).

- This simple technique builds rapport, gathers information, and functions as a “social buffer” by signaling, “I am listening, and I am with you.”

- Labeling: This is the core neuro-intervention and the practical application of “affect labeling.” The agent uses neutral, observational phrases: “It seems like…” or “It sounds like…” (e.g., “It sounds like you’re feeling rushed and pressured by the process.”)

- This defuses the negative emotion by triggering the client’s own PFC to activate and dampen their amygdala. This is a core skill for emotional regulation for real estate agents.

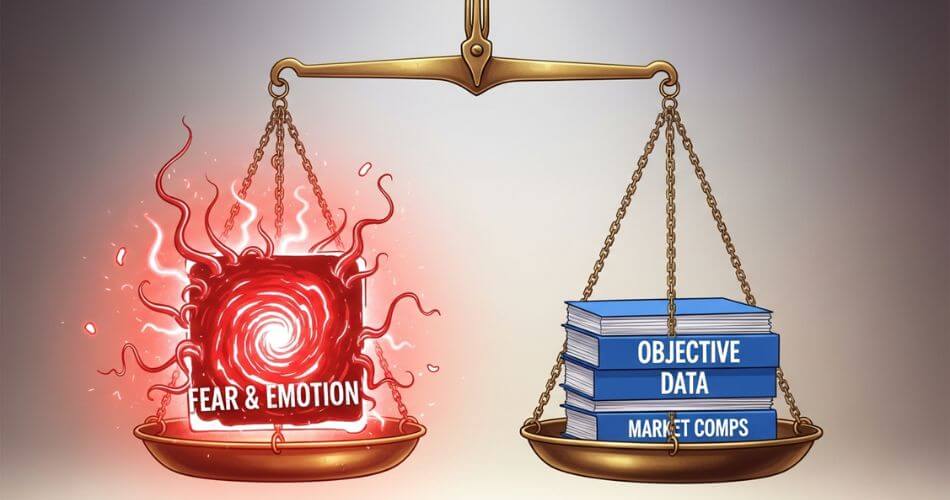

Pillar 3 (DO): Providing 'Objective Criteria' to Empower a Rational Decision

The final pillar is DO. This framework provides the structure for the “surrogate PFC” to operate.

Once the client’s emotional state is de-escalated (Pillar 2), the agent provides the logical scaffolding for a wise decision, using principles from “Principled Negotiation” (Harvard Program on Negotiation).

Separate the People from the Problem:

This is the operational sequence. It recognizes the brain’s hierarchy. An agent must first address the person and their emotional hijack (the “people problem”) using Labeling.

Only then can they pivot to the substantive issue (the “problem”).

Insist on Using Objective Criteria:

This is the content that the “surrogate PFC” provides. When the client is hijacked by emotion (e.g., “Let’s just offer R100k over, I’m tired of this!”), the agent does not respond with a competing emotion.

They supply “objective criteria”—market value, comparable sales data, industry protocol, legal standards.

This grounds the conversation in external, independent logic, allowing the client’s (now regulated) brain to make a sound, defensible decision.

The anxiety of real estate is real, biological, and predictable. But it is not unmanageable. Understanding the psychology of buying a house is less about curb appeal and more about neurobiology.

It reveals that the role of trust in high-stakes transactions is not a “soft skill” but the primary mechanism for success. The commitment is made before the paperwork. It is made the moment the client’s nervous system feels safe.

The agent who understands this stops being a salesperson and becomes the most valuable guide a person can have.

About the Author

Andre Swart is a respected leader in Brackenfell real estate with over 20 years of results-driven experience. Through his platform, “Andre Swart Inspires,” he moves beyond simple property sales to share the proven mindset, strategies, and habits that build lasting success.

Grounded in integrity, Andre’s mission is to mentor the next generation of top agents and provide homeowners with the trusted guidance they deserve.

An Important Note on the Frameworks Used

This article is intended for informational and educational purposes only. It is not, and should not be considered, a substitute for professional medical, psychiatric, or psychological advice, diagnosis, or treatment.

The scientific and clinical concepts discussed, such as Polyvagal Theory , amygdala hijack , affect labeling , and Relocation Stress Syndrome , are used as explanatory frameworks to better understand the dynamics of communication, emotional regulation, and trust-building in a high-stakes business context.

The models presented are not intended to be used for clinical diagnosis or to replace the vital role of a qualified mental health professional.