Safe Home Selling Guide for Seniors.

The Over-55's Guide to Selling Property in Brackenfell

Your step-by-step blueprint for a secure, profitable, and stress-free home sale in the Northern Suburbs.

After decades of turning the key in the same lock, the thought of selling your long-term home can feel overwhelming.

The rooms are repositories of memory, from height charts etched into a doorframe to the echoes of family gatherings.

This decision is not just a financial transaction; it is a significant life event. Many homeowners in your position feel a deep anxiety about the process, fearing the unknown and the risk of being taken advantage of.

This safe home-selling guide for seniors is designed to replace that anxiety. It is a blueprint for empowerment, giving you a clear, step-by-step plan for a secure and confident sale.

Understanding the Emotional Journey of Selling Your Home

What is 'Seller's Grief' and Why It's Normal?

Before we discuss contracts or commissions, we must first acknowledge the emotional foundation of this process.

The feeling of distress you may have is not just simple sadness; it is a recognized concept known as “seller’s grief”.

This is the deep emotional undercurrent that can influence a seller’s behaviour, often stemming from the circumstances forcing the sale, such as financial hardship, declining health, or the loss of a spouse.

This grief is a direct response to the loss of identity, security, and belonging that the home provided for so long. It is so powerful that it is considered a tangible risk in the property industry, as it can lead to unpredictable behaviour, sudden changes of heart, or a reluctance to complete the sale.

Even if your sale is voluntary, perhaps you are downsizing by choice, the feelings are just as valid. Psychologists identify this as a “living loss” or “ambiguous loss”.

You are grieving the role of the house, which still physically exists but is no longer your “family home”. During viewings, you may experience your own home as “psychologically gone,” which is a profoundly unsettling feeling.

These feelings of loss and anxiety are a normal, validated, and predictable part of the process for any long-term homeowner.

The Unique Stress of Downsizing a Lifetime of Memories. The decision to sell is often directly linked to the practical need to downsize, which brings its own specific stress.

You are not just moving; you are being asked to condense a lifetime of possessions into a significantly smaller space. This forces you to confront every single item you own and make a decision, which becomes a major and emotional issue.

This challenge is particularly acute here in South Africa. Compared to many European countries, our family homes tend to be much larger.

Therefore, the physical and emotional act of moving from a large freehold property to a more compact sectional title unit is a more extreme and demanding undertaking.

This process can also trigger a deep anxiety about moving to an unfamiliar environment and a fear of losing your autonomy, especially if the move is happening after a medical event or the death of a partner.

Coping Strategies: How to Find Closure and Move Forward

Acknowledging these feelings is the first step. The next step is to manage them. This is the heart of coping with selling the family home and moving forward with clarity.

Reframe your mindset. It is important to validate your emotions of sadness and nostalgia without judgment. At the same time, consciously focus on the positive aspects of your transition.

Are you moving for greater security? For less maintenance? For a new sense of freedom? Keep these positive goals at the forefront of your mind.

Create formal closure rituals. This is a powerful way to honour your memories and process the transition. Before you pack, create a “Memory Collection”.

This could be a photo album or scrapbook that captures the essence of your time in the house. This act externalizes the memories from the physical building and puts them into a tangible keepsake you can take with you.

Another wonderful strategy is to host a “Farewell Gathering”. Invite family and friends to share stories and collectively celebrate the special moments you all spent in the home. This turns the process from a private loss into a positive, shared experience.

Manage the sale process. Viewings can be difficult. Acknowledge that your emotions may surface when strangers are walking through your home.

It is perfectly acceptable, and often advisable, to schedule viewings at times when you can step out. This gives you the space to feel without judgment and allows buyers the freedom to explore.

Your Step-by-Step Legal & Financial Checklist

The 7 Pre-Sale Essentials You Must Complete

Once you have an emotional strategy, the next step is to build a practical, logical plan. This checklist demystifies the process, giving you a clear path to follow.

This is your initial legal framework. Completing these seven steps puts you in full control from day one.

- Confirm Your Title Deed: You must have your original Title Deed. If your property is bonded, the bank will hold the original, and your conveyancer will manage this.

- Settle Outstanding Municipal Accounts: All rates and utility bills must be paid. A conveyancer cannot lodge the transfer without a valid Municipal Clearance Certificate from the city.

- Obtain Mandatory Compliance Certificates: You are legally required to provide certificates proving the home’s installations are safe and compliant. We will detail these below.

- Sign an Agent Mandate: You must sign a formal, written mandate with your chosen estate agent. Read this document carefully and understand its terms, such as the commission rate and whether it is a sole or open mandate.

- Disclose Known Defects: You are legally required to provide a full, written disclosure of any known defects in the property. Honesty is non-negotiable.

- Review the Offer to Purchase (OTP): The OTP is a binding legal contract. Never sign it without having your appointed conveyancer review it first.

- Appoint a Conveyancer: In South Africa, the seller typically has the right to appoint the conveyancer who will handle the transfer. Choose an experienced professional you trust.

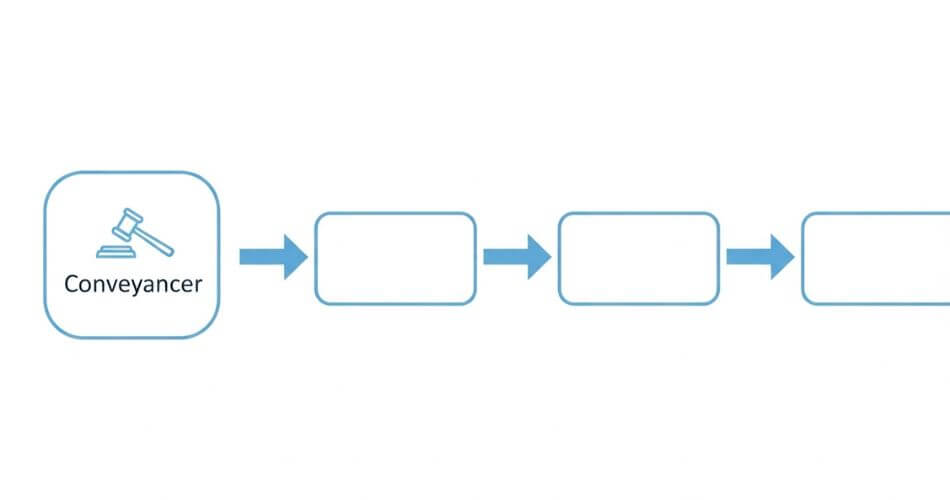

Navigating the Conveyancing Process in South Africa

The conveyancer is the legal specialist who manages the entire transfer. While it seems complex, the process follows a defined path.

Step 1: Offer to Purchase (OTP) Signed: The process begins once a valid OTP is signed by both you and the buyer.

Step 2: Conveyancer Appointed: The conveyancer drafts and reviews contracts, conducts property searches for any outstanding debts or legal issues, and prepares all documents for the Deeds Office.

Step 3: Bond Cancellation and Registration: The conveyancer manages the cancellation of your existing bond (if you have one) and coordinates with the buyer’s attorneys for the registration of their new bond.

Step 4: Obtain Clearances: This is a key step. The conveyancer obtains the Rates Clearance Certificate from the municipality and, for a sectional title, a Levy Clearance Certificate from the Body Corporate. Delays here are common if accounts are not settled.

Step 5: Lodge at Deeds Office: Once all documents are signed and clearances are in hand, the file is lodged at the Deeds Office for legal registration.

Step 6: Registration and Handover: Upon successful registration, the property is legally transferred. The proceeds of the sale are paid to you, and you hand over the keys to the new owner.

Mandatory Compliance Certificates in Cape Town (Explained)

As a seller, you are responsible for providing several compliance certificates to the conveyancer before registration.

These are non-negotiable. When you hear about property compliance certificates Cape Town, these are what it refers to.

- Electrical Compliance Certificate: Confirms all electrical installations are safe and compliant.

- Gas Compliance Certificate: Required if your property has any gas appliances, like a hob or fireplace.

- Electric Fence Certificate: Required if you have an electric fence installed.

- Beetle Clearance Certificate: This is a requirement “commonly required in coastal provinces,” which includes all of Cape Town. It confirms the property is free from wood-boring beetle infestation.

- Water Installation Certificate: This is a specific by-law requirement for properties in Cape Town. It certifies that water installations (toilets, taps) are free from leaks and comply with municipal water-saving regulations.

Capital Gains Tax for Pensioners: Debunking Myths and Calculating What You Really Pay

One of the biggest financial anxieties is tax. Let’s clarify the rules on capital gains tax on primary residence in South Africa.

The R2 Million Primary Residence Exclusion: First, the good news. SARS allows for a R2 million exclusion on the capital gain from the sale of a primary residence.

This “gain” is your Sale Price minus your “Base Cost.” If your total gain is less than R2 million, you will not pay any Capital Gains Tax (CGT). If you own the home jointly with a spouse, this exclusion is split R1 million each.

The “Senior CGT Exemption” Myth: You must be aware of a common and costly misconception. SARS documentation mentions an R1.8 million exclusion for individuals aged 55 or older.

Many homeowners incorrectly believe this can be added to the R2 million exclusion. This is false. The R1.8 million exclusion applies only to the disposal of small business assets, not the sale of your primary residence. Your only major exclusion is the R2 million primary residence exclusion.

The Senior Insurance Trap: While reviewing your finances, there is a critical trap to avoid. Many long-term homeowners confuse “Home Owner’s Cover” (HOC, or Building Insurance) with “Mortgage Protection Insurance” (Bond Cover).

Bond Cover is a life policy that pays the bank your outstanding bond if you die. If you have paid off your bond, or the balance is very small, this policy is likely redundant, yet you may still be paying for it.

HOC (Building Insurance) covers the physical structure against fire or flood and pays you to rebuild. It is highly probable that your HOC is still based on your home’s value from decades ago, leaving you critically under-insured at today’s high rebuild costs.

Your actionable step is to call your broker immediately, likely cancel the useless Bond Cover, and urgently update your HOC to reflect the full 2025 rebuild cost.

Your Shield Against Scams: How to Securely Vet Your Agent

Common Scams Targeting Senior Homeowners

Your core fear may be exploitation. This is where you move from a passive position to an active, defensive one.

Scammers specifically target seniors using methods that prey on trust or technological unfamiliarity. Be aware of them.

Phishing & Digital Fraud: You may receive fraudulent emails or messages that look like they are from your bank or conveyancer, creating urgency to steal your banking details.

Criminals may also call, posing as bank officials, to “reverse a transaction” and ask for your One-Time PIN (OTP). A legitimate institution will never call you and ask for your OTP.

Impersonation & Listing Fraud: “Bogus agents” who are not registered are a real threat. They may list a property they don’t have rights to, collect a deposit, and disappear.

Emotional Manipulation: Be wary of the “Grandparent Scam” (a call from a “grandchild” in urgent trouble needing money) or “Romance Scams” (preying on loneliness to build trust before manufacturing a financial crisis).

The Single Most Important Document: The Fidelity Fund Certificate (FFC)

Your primary shield against fraud is a legal document: the Fidelity Fund Certificate (FFC). It is a legal requirement for any property practitioner to practice.

This certificate is your proof that the agent is properly registered with the national regulatory body, the Property Practitioners Regulatory Authority (PPRA), and that they are qualified (e.g., NQF Level 4) and tax-compliant.

Here is why it is so important: the FFC is your only financial protection. By using a registered agent with a valid FFC, you are protected by the Estate Agency Fidelity Fund.

This fund is specifically designed to reimburse consumers who suffer financial losses due to the theft of trust monies by an estate agent. If you use an unregistered, “bogus” agent, you have zero protection and no recourse.

A 3-Step Process to Verify Any Property Practitioner

This is how to verify an estate agent in South Africa. Do not feel “rude” for asking; a true professional will expect it and be impressed by your diligence. A scammer will make excuses.

Step 1: Request the FFC. Ask the agent to provide a copy of their personal FFC and their agency’s FFC. Both must be valid for the current year.

Step 2: Verify the FFC. Do not trust the piece of paper, as it can be forged. You must independently verify it by calling the PPRA’s verification line directly at 087 285 3222.

Step 3: Verify the Trust Account. Never pay any funds (like a deposit) into an agent’s personal or “business” account.

By law, all client funds must be held in a registered Fidelity Fund trust account, which is audited. Verifying the FFC in Step 2 confirms their firm has a valid trust account.

A Practical Plan for Downsizing and Moving

The 4-Box Method for Overwhelm-Free Sorting

This section is dedicated to practical downsizing tips for seniors, designed to manage the physical and emotional overwhelm.

The key to downsizing is not to rush. Treat it as a long-term project, not a single event.

Phase 1: Plan and Measure. Before you sort a single item, get the floor plan of your new home. Measure your essential, large furniture items (bed, couch, dining table) and the new doorways. This makes the “keep” or “go” decision objective: “Will it physically fit?”

Phase 2: Sort with the Four-Box Method. This is a simple, effective system. Get four large boxes and label them: “Keep,” “Donate,” “Sell,” and “Trash”. Every item in a room must be placed into one of these four categories.

Phase 3: Execute. Start small to build momentum, for example, with a single drawer or cupboard. Set a timer for 60 minutes to make the task less daunting. Do not hesitate to involve family, friends, or a professional senior moving service for support.

Tips for Letting Go of Sentimental Items

The most exhausting part of downsizing is that every item requires a decision. Emotional attachment can become a practical roadblock.

Challenge the “Scarcity Mindset.” We often cling to items thinking, “What if I need this one day?”. If you have not used it in years, you likely will not.

Ask Critical Questions. When holding an item, ask yourself: “Is this a good memory or a bad one? Why am I keeping it?”. And more importantly: “Am I treasuring this (displaying it, using it), or am I just storing it?”.

Go Digital. For items that are purely sentimental but have no practical use (like children’s artwork or old letters), take high-quality pictures to preserve the memory, and then let the physical object go.

Be Realistic About “Heirlooms.” Before you build a pile of items for your children, ask them if they actually want them. It is better to ask than to burden them with items that are only sentimental to you.

Your Moving Day 'Accessible Essentials' Checklist

Moving day itself is amplified in difficulty for senior citizens. It is a time of high physical and medical stress, and disrupting a daily medication routine can be dangerous.

Your single most important preparation is an “Accessible Essentials Bag”. This bag does not go on the moving truck. It stays with you at all times.

Your Essentials Bag must contain:

- All your daily medications.

- Important documents (ID, new keys, contract with the movers).

- Phone and phone charger.

- Wallet, credit cards, and cash.

- A few precious items (e.g., jewelry).

- In the weeks before the move, also be sure to:

- Notify all accounts of your change of address (banks, insurance, subscriptions).

Schedule utilities: Disconnect services at your old home for the day after you move, and connect them at your new home for the day before you arrive. Transfer all medical prescriptions to a new pharmacy near your new home.

The Brackenfell Market: Why You Are in a Position of Strength

Current Property Prices in Brackenfell (2025 Data)

Finally, let’s replace any lingering anxiety with objective, hard data. You are not selling your home in a weak or desperate position. In the current Brackenfell market, the opposite is true.

Analysis of South African Deeds Office data for 2024 provides a clear picture. The median sales price for Freehold (Erven) properties, the type of long-term family home you likely own, is R1.95 million.

More importantly, the five-year growth (2019-2024) for these Freehold homes has been a massive +34.5%. This massively outperforms the Sectional Title market, which saw only +18.6% growth in the same period.

This data confirms that your asset is the most in-demand, highest-growth property type in your area.

Why Buyers Are Competing for Homes Like Yours

Your property’s value is being driven by powerful market dynamics.

A Significant Stock Shortage: The number of homes for sale in the Northern Suburbs has dropped to a multi-year low. In the comparable suburb of Durbanville, active listings dropped by nearly 50% in a single year. This lack of supply creates “favourable conditions for sellers” and reduces your competition.

High Rental Market Pressure: The local rental market is experiencing a “significant squeeze” as demand has “skyrocketed”. Agents report receiving multiple applications for a single rental, often above the asking price, on the day it is listed. This high demand and high cost of renting pushes more people into the buying market.

The “Semigration” Driver: There is sustained interest from buyers relocating from Gauteng and KwaZulu-Natal, who are drawn to the lifestyle and perceived security of the Western Cape.

Turning Market Knowledge into Negotiating Power

This is where all the information comes together. The dominant buyer profile for homes in the Northern Suburbs is families.

The most active buyer age bracket is 36-49 years old, and they are specifically motivated by the area’s excellent schools (with more than 15 multi-lingual schools in the Durbanville area alone) and the “country lifestyle”.

Your anxiety is directly contradicted by this market reality. You are not in a weak or exploitable position. You are in a position of maximum strategic strength.

You hold the most desirable and scarce asset type (a freehold family home) in a market characterized by a critical supply shortage and a large pool of competing, motivated buyers. You are in control.

Selling your home after decades is a significant event, but it is not a process to be feared. It is a process you can, and will, manage with confidence and security.

This safe home selling guide for seniors was designed to give you that control, to show you that you are an active and empowered steward of your legacy.

When you are ready to turn this plan into action, my team and I are here to provide a confidential, no-obligation consultation. Let us help you secure the future you deserve.

About the Author

Andre Swart is a respected leader in Brackenfell real estate with over 20 years of results-driven experience. Through his platform, “Andre Swart Inspires,” he moves beyond simple property sales to share the proven mindset, strategies, and habits that build lasting success.

Grounded in integrity, Andre’s mission is to mentor the next generation of top agents and provide homeowners with the trusted guidance they deserve.